As the first step, we’ll begin by listing out the model assumptions for our simple exercise. One common misconception pertains to the difference between the CM and the gross margin (GM). Investopedia contributors come from a range of backgrounds, and over 25 years there have been thousands of expert writers and editors who have contributed. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Contribution Margin Per Unit

All of our content is based on objective analysis, and the opinions are our own.

How do you find the contribution margin per direct labor hour?

The same will likely happen over time with the cost of creating and using driverless transportation. Regardless of how contribution margin is expressed, it provides critical information for managers. Understanding how each product, good, or service contributes to the organization’s profitability allows managers to make decisions such as which product lines they should expand or which might be discontinued. When allocating scarce resources, the contribution margin will help them focus on those products or services with the highest margin, thereby maximizing profits. The contribution margin tells us whether the unit, product line, department, or company is contributing to covering fixed costs.

The Formula and Result

Conceptually, the contribution margin ratio reveals essential information about a manager’s ability to control costs. In May, \(750\) of the Blue Jay models were sold as shown on the contribution margin income statement. The contribution margin may also be expressed as fixed costs plus the amount of profit. It is the monetary value that each hour worked on a machine contributes to paying fixed costs.

Contribution Margin vs. Gross Margin: What is the Difference?

Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement. A contribution margin analysis can be done for an entire company, single departments, a product line, or even a single unit by following a simple formula.

Doing this break-even analysis helps FP&A (financial planning & analysis) teams determine the appropriate sale price for a product, the profitability of a product, and the budget allocation for each project. However, they will play an important part in calculating the net income formula. Further, it is impossible for you to determine the number of units that you must sell to cover all your costs or generate profit.

Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income. Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable xero vs zoho books costs and introduced the basics of cost behavior. Let’s now apply these behaviors to the concept of contribution margin. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. In our example, the sales revenue from one shirt is \(\$15\) and the variable cost of one shirt is \(\$10\), so the individual contribution margin is \(\$5\).

- An increase like this will have rippling effects as production increases.

- This strategy can streamline operations and have a positive impact on a firm’s overall contribution margin.

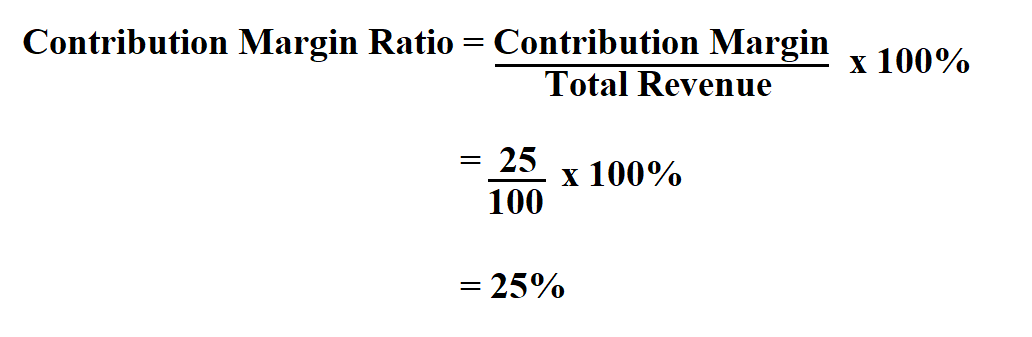

- The Contribution Margin Ratio is the product revenue remaining after deducting all variable costs, expressed on a per-unit basis.

- The difference between fixed and variable costs has to do with their correlation to the production levels of a company.

- To demonstrate this principle, let’s consider the costs and revenues of Hicks Manufacturing, a small company that manufactures and sells birdbaths to specialty retailers.

Contribution margin is the variable expenses plus some part of fixed costs which is covered. Thus, CM is the variable expense plus profit which will incur if any activity takes place over and above BEP. The difference between the selling price and variable cost is a contribution, which may also be known as gross margin. You can calculate the contribution margin by subtracting the direct variable costs from the sales revenue. It is important for you to understand the concept of contribution margin.

Investors often look at contribution margin as part of financial analysis to evaluate the company’s health and velocity. You can even calculate the contribution margin ratio, which expresses the contribution margin as a percentage of your revenue. While a high contribution margin ratio is impressive, it is important to note that companies should not sacrifice the quality of their product or service purely for the sake of increasing the contribution margin ratio. Striking a balance is essential for keeping investors and customers happy for the long-term success of a business. The gross sales revenue refers to the total amount your business realizes from the sale of goods or services.

A key characteristic of the contribution margin is that it remains fixed on a per unit basis irrespective of the number of units manufactured or sold. On the other hand, the net profit per unit may increase/decrease non-linearly with the number of units sold as it includes the fixed costs. The contribution margin shows how much additional revenue is generated by making each additional unit of a product after the company has reached the breakeven point. In other words, it measures how much money each additional sale “contributes” to the company’s total profits. Watch this video from Investopedia reviewing the concept of contribution margin to learn more. Keep in mind that contribution margin per sale first contributes to meeting fixed costs and then to profit.

Thus, the total manufacturing cost for producing 1000 packets of bread comes out to be as follows. Contribution margin calculation is one of the important methods to evaluate, manage, and plan your company’s profitability. Further, the contribution margin formula provides results that help you in taking short-term decisions. In effect, the process can be more difficult in comparison to a quick calculation of gross profit and the gross margin using the income statement, yet is worthwhile in terms of deriving product-level insights.