That is it does not include any deductions like sales return and allowances. Thus, the total variable cost of producing 1 packet of whole wheat bread is as follows. For this section of the exercise, the key takeaway is that the CM requires matching the revenue from the sale of a specific product line, along with coinciding variable costs for that particular product.

Our Services

The benefit of expressing the contribution margin as a percentage is that it allows you to more easily compare which products are the most valuable to your business. This metric is typically used to calculate the break even point of a production process and set the pricing of a product. They also use this to forecast the profits of the budgeted production numbers after the prices have been set. If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred. You need to fill in the following inputs to calculate the contribution margin using this calculator. As you can see, the contribution margin per-unit remains the same.

Ready to Level Up Your Career?

In our example, the sales revenue from one shirt is $15 and the variable cost of one shirt is $10, so the individual contribution margin is $5. This $5 contribution margin is assumed to first cover fixed costs first and then realized as profit. The contribution margin is different from the gross profit margin, the difference between sales revenue and the cost of goods sold. While contribution margins only count the variable costs, the gross profit margin includes all of the costs that a company incurs in order to make sales. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. A contribution margin ratio of 40% means that 40% of the revenue earned by Company X is available for the recovery of fixed costs and to contribute to profit.

Fixed Costs vs. Variable Costs

For example, if the cost of raw materials for your business suddenly becomes pricey, then your input price will vary, and this modified input price will count as a variable cost. xero odbc driver Say, your business manufactures 100 units of umbrellas incurring a total variable cost of $500. Accordingly, the Contribution Margin Per Unit of Umbrella would be as follows.

How to calculate the contribution margin and the contribution margin ratio?

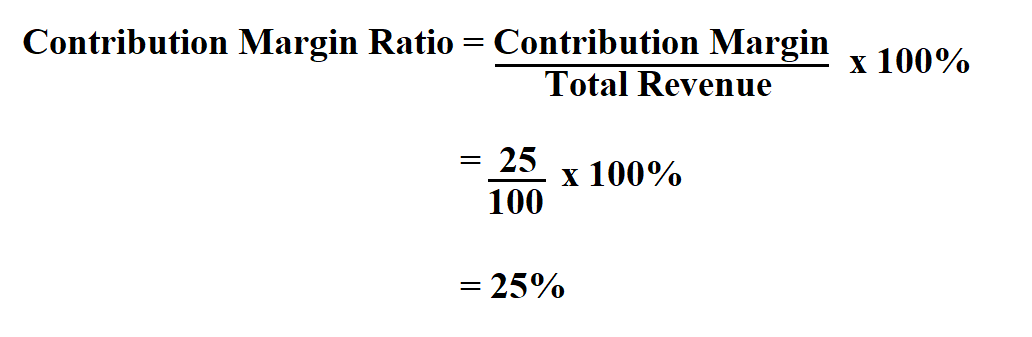

In order to calculate the contribution margin ratio, you’ll first need to calculate the contribution margin. The Contribution Margin Calculator is an online tool that allows you to calculate contribution margin. You can use the contribution margin calculator using either actual units sold or the projected units to be sold. This means Dobson books company would either have to reduce its fixed expenses by $30,000. On the other hand, net sales revenue refers to the total receipts from the sale of goods and services after deducting sales return and allowances.

For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s. Since machine and software costs are often depreciated or amortized, these costs tend to be the same or fixed, no matter the level of activity within a given relevant range. Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits. It means there’s more money for covering fixed costs and contributing to profit. That can help transform your labor costs from a variable expense to a fixed expense and allow you to keep those expenses under tighter control.

- This can be a valuable tool for understanding how to price your products to ensure your business can pay its fixed costs, such as salaries and office rent, and still generate a profit.

- We’ll start with a simplified profit and loss statement for Company A.

- Investors often look at contribution margin as part of financial analysis to evaluate the company’s health and velocity.

- To get the ratio, all you need to do is divide the contribution margin by the total revenue.

- It is considered a managerial ratio because companies rarely report margins to the public.

Any remaining revenue left after covering fixed costs is the profit generated. The contribution margin is computed as the selling price per unit, minus the variable cost per unit. Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company. That said, most businesses operate with contribution margin ratios well below 100%. Break even point (BEP) refers to the activity level at which total revenue equals total cost.

This $60 represents your product’s contribution to covering your fixed costs (rent, salaries, utilities) and generating a profit. Contribution margin ratio is a calculation of how much revenue your business generates from selling its products or services, once the variable costs involved in producing and delivering them are paid. This can be a valuable tool for understanding how to price your products to ensure your business can pay its fixed costs, such as salaries and office rent, and still generate a profit. Let’s examine how all three approaches convey the same financial performance, although represented somewhat differently. The break even point (BEP) is the number of units at which total revenue (selling price per unit) equals total cost (fixed costs + variable cost).

- Free Random Video Chat With Strangers Online

- 12 Greatest Online Chat Rooms In 2024

- Jerkmate Review: The Neatest Cam Site

- Hướng dẫn lập biểu đồ ngày sinh Thần số học (Đơn giản)

- Jetbahis Bahis – Türkiye’nin En İyi Bahis Sitesi Jetbahis Türkiye – Sınırsız Kazanç İmkanları ve Yüksek Oranlarla Bahis Keyfi